Executive Summary

In our 2014 inaugural report, “Risky Business: The Economic Risks of Climate Change in the United States,” we found that the economic risks from unmitigated climate change to American businesses and long-term investors are large and unacceptable. Subsequent scientific data and analysis have reinforced and strengthened that conclusion. As a result, we, the Co-Chairs and Risk Committee of the Risky Business Project, are united in recognizing the need to respond to the risk climate change poses to the American economy.

Now we turn to the obvious next question: how to respond to those risks. Seriously addressing climate change requires reducing greenhouse gas emissions by at least 80 percent by 2050 in the U.S. and across all major economies. We find that this goal is technically and economically achievable using commercial or near-commercial technology. Most important, we find that meeting the goal does not require an energy miracle or unprecedented spending.

The transition to a cleaner energy economy rests on three pillars: moving from fossil fuels to electricity wherever possible, generating electricity with low or zero carbon emissions, and using energy much more efficiently. This means building new sources of zero- and low-carbon energy, including wind, solar, and nuclear; electrifying vehicles, heating systems, and many other products and processes; and investing in making buildings, appliances, and manufacturing more energy efficient.

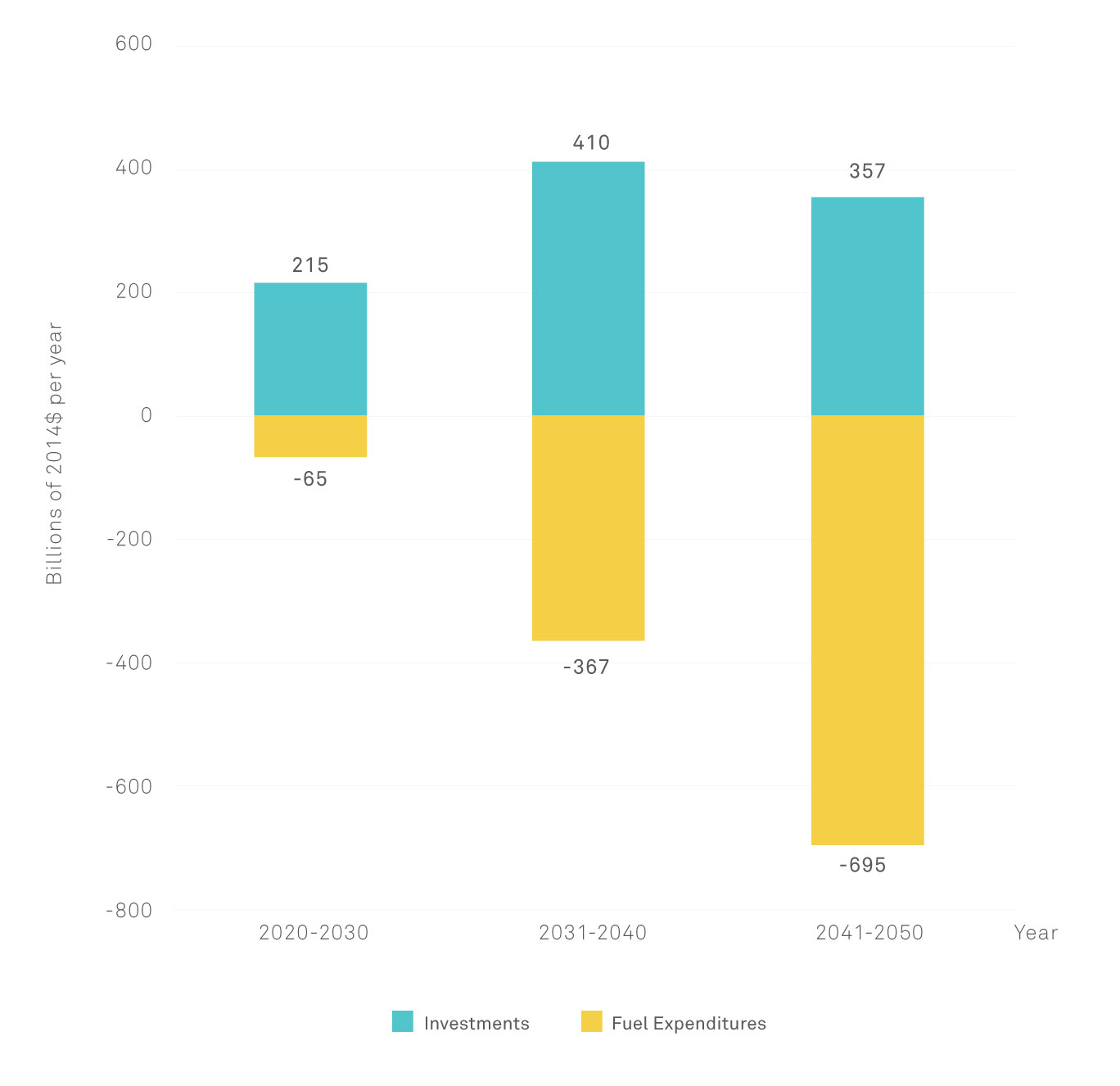

Meeting these targets requires a large-scale shift away from ongoing spending on fossil fuels and toward up-front capital investments in clean energy technologies. Many of those, such as wind and solar, have little or no fuel cost once built. Given an appropriate policy framework, we expect these investments to be made largely by the private sector and consumers, and to yield significant returns. Because of the large capital investments and the long-term savings in fuel costs, this shift presents significant opportunities for many American investors and businesses. Notably, shifting the U.S. to a low-carbon, clean energy system presents not just long term benefits but also immediate, near-term opportunities, particularly for those actors best positioned to capitalize on these trends.