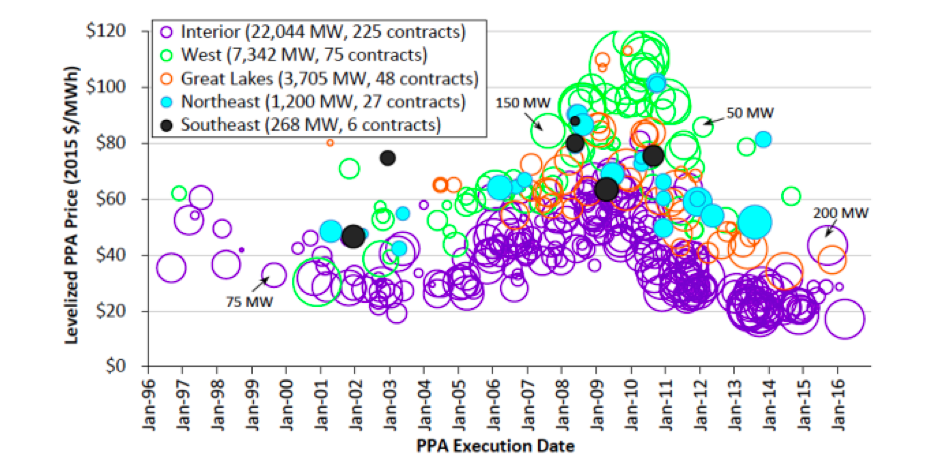

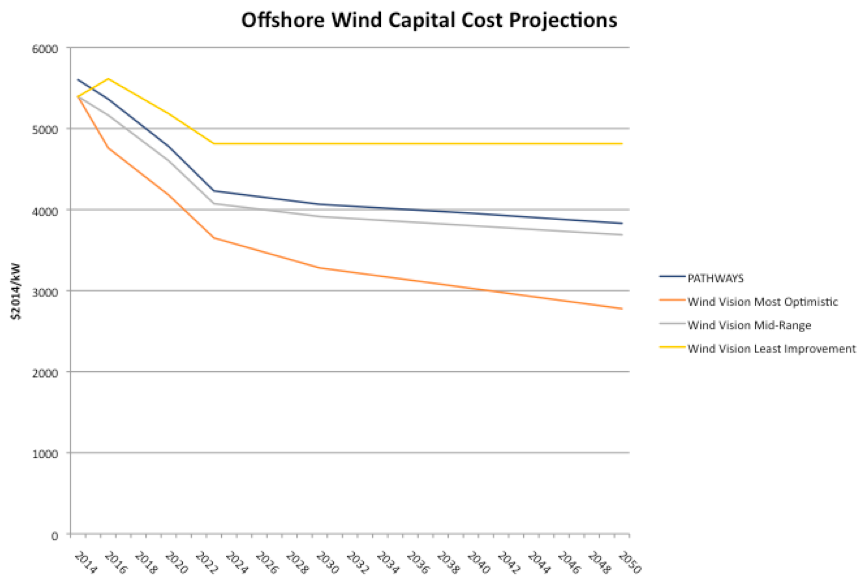

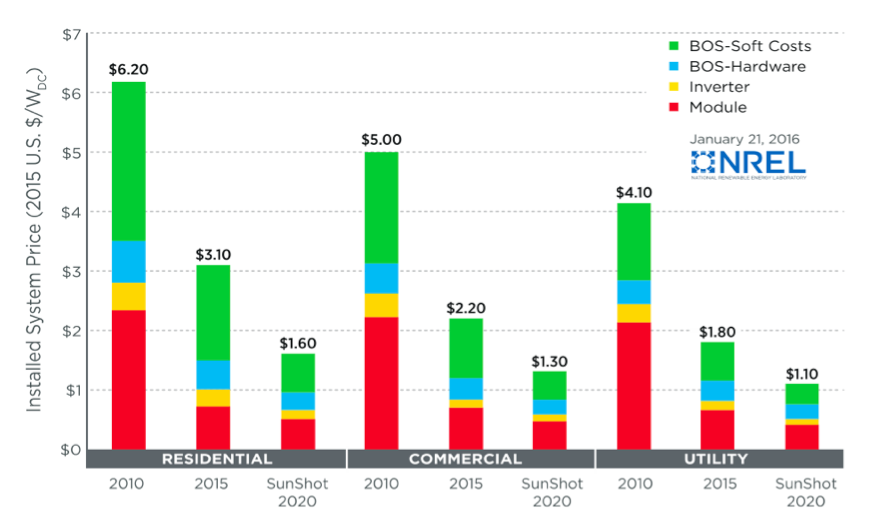

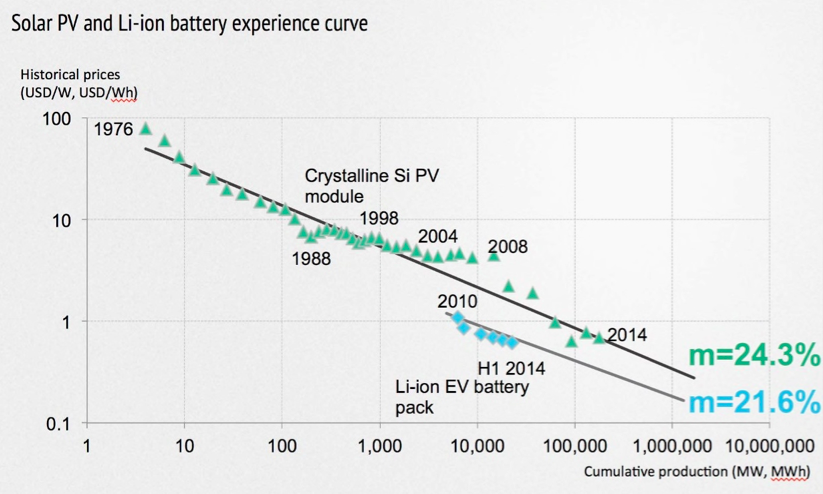

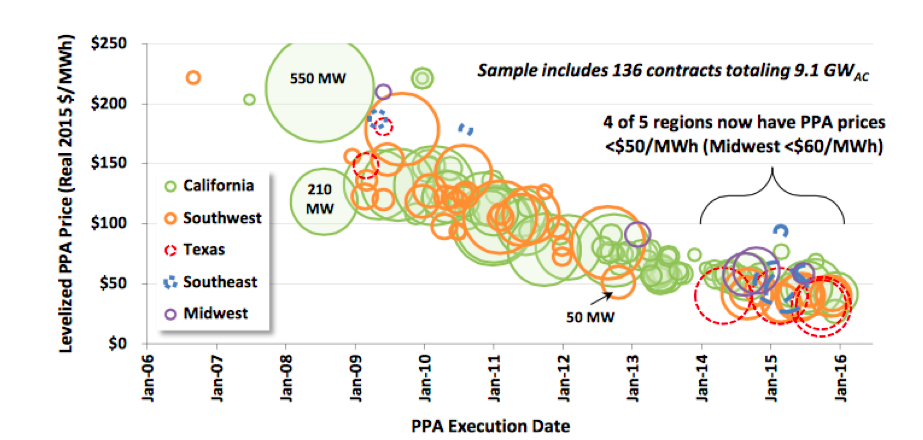

In general, after looking at the modeling assumptions in the context of other studies, we find that the PATHWAYS model assumptions and findings are consistent with mid-range expectations in the other recent studies. Some cost reductions must be achieved over the next few decades, but they are not overly optimistic and can likely be achieved with the expected level of R&D investment and deployment expected. However, few studies have projected the high levels of electricity generation needed to meet the aggressive carbon reduction goals, so some deployment feasibility findings are not directly comparable.

PATHWAYS Generation Supply Curve Development

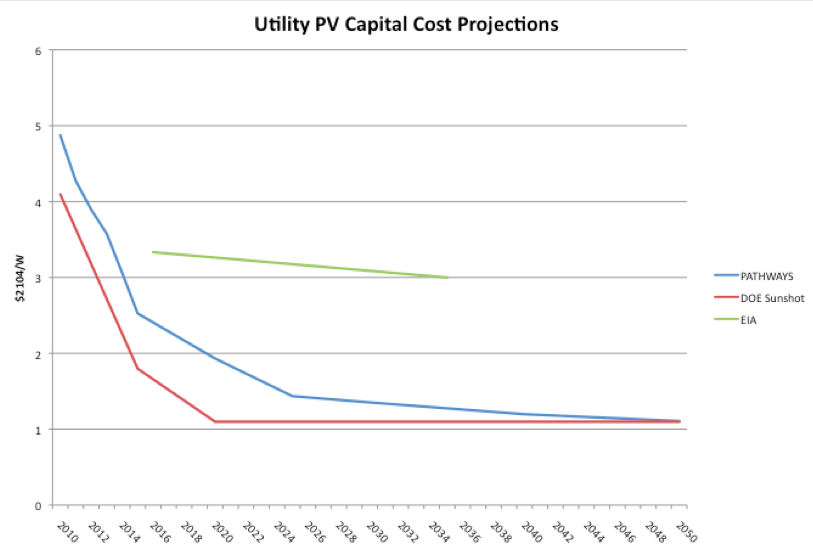

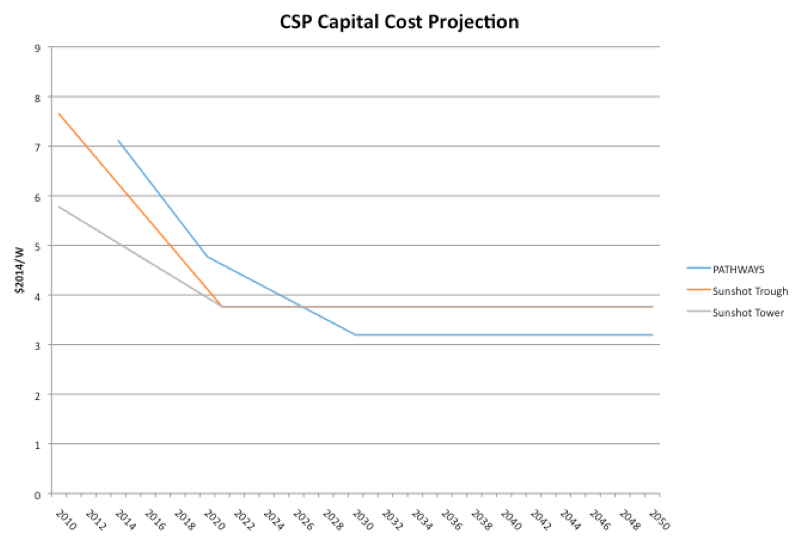

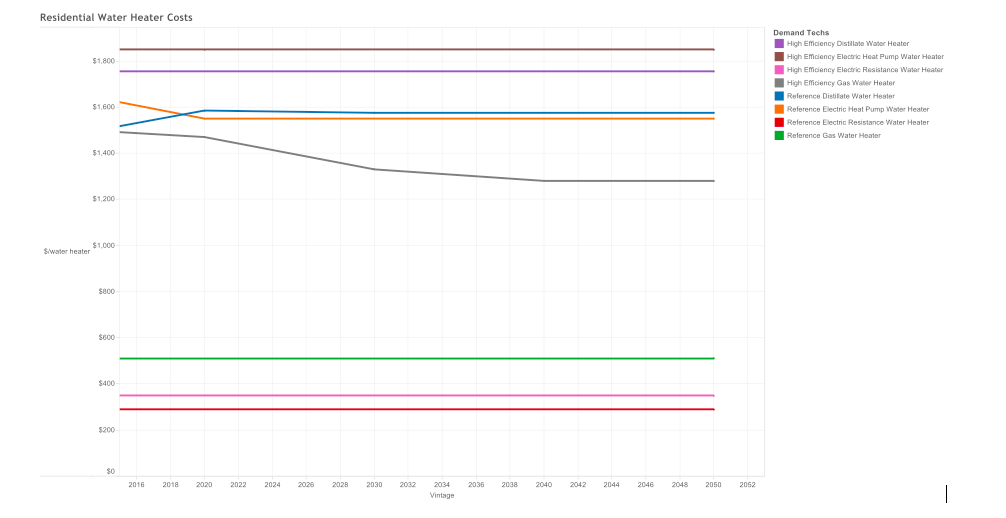

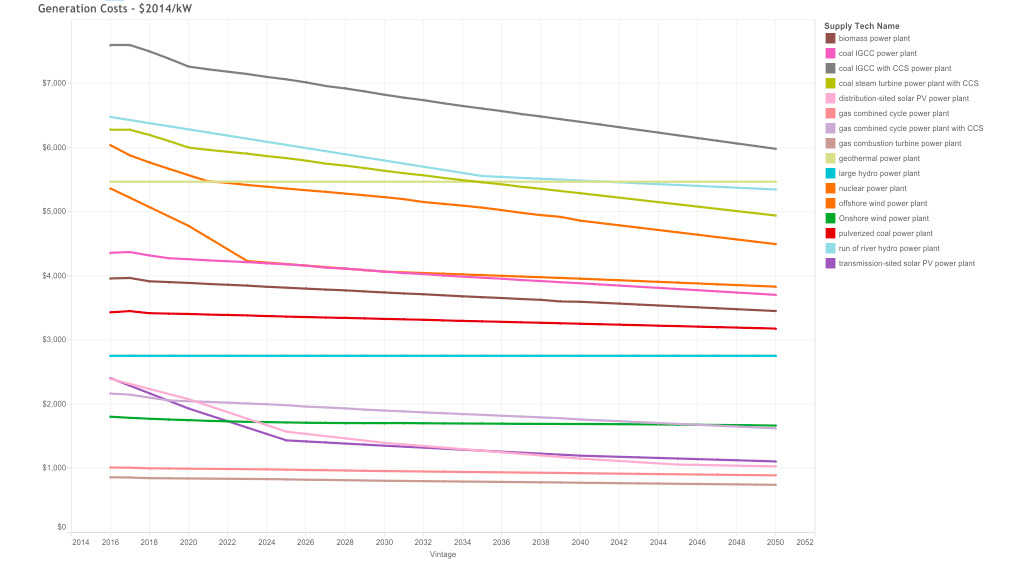

The primary cost for most renewable energy technologies is the upfront capital cost investment. Figure A-2-1 presents the PATHWAYS projections for capital costs (in 2014$) for all generation supply options.

Figure A-2-1. Capital Cost Projections for Power Generation

The model must also make assumptions about the electricity generating potential for the various technologies. Capacity factor is the most widely used metric to compare technology performance. It is the theoretical capacity of the generator divided by electricity generated over time. One problem with using capacity factor as a metric for comparison is that the technology capability is muddled with other factors, including resource availability and access to transmission.

The PATHWAYS model defines an input capacity factor that is based on the technology capability. Table A-2-1 presents the PATHWAYS assumptions for capacity factors for renewable energy technologies for the modeling period 2016-2050. They are based on technology performance and the low, high, and average value reflect location-specific availability of the resources (e.g., solar insolation, wind speed).

Table A-2-1. Capacity Factors for Renewable Power Generation Options

| Technology | Low Capacity Factor | High Capacity Factor | Average Capacity Factor |

|---|---|---|---|

| Rooftop PV | 14% | 19% | 16% |

| Transmission-sited PV | 17% | 24% | 20% |

| Large hydro & run-of-river hydro | 21% | 40% | 33% |

| Offshore Wind (Coastal Areas Only) | 29% | 46% | 37% |

| Onshore Wind | 26% | 42% | 30% |

Potential sites are categorized based on both an estimated quality of the renewable resource and an estimated cost of building the transmission interconnection from that site to access the grid. The PATHWAYS model uses renewable energy supply curves from the EPA’s MARKAL model and compressed the 25 MARKAL bins (five capacity factor bins times five transmission bins) into a weighted average capacity factor of the five transmission bins, with 1 being the easiest and cheapest to build transmission. In this way, the model does not necessarily build out the highest resource areas first, but is constrained by the estimated cost and difficulty of building transmission in that area. No transmission costs are added for distributed resources like rooftop solar.

The output capacity factor is calculated by the model and it reflects what plants the model projects are built, how the plants are constrained (for non-dispatchable technologies), and how the plants are dispatched (for dispatchable technologies). Table A-2-2 presents the the output capacity factors for the major generating technologies in the PATHWAYS study. The first percentage number in each table entry represents the capacity factor in 2016, and the second percentage number represents the capacity factor in 2050. A single percentage number indicates either that there was no change over the modeling period or that the changes in the interim period were slight and the percentage in 2050 had returned to what it was at the beginning of the modeling.

Table A-2-2. Output Capacity Factors for Power Generation Options

| Technology | High Carbon Reference (2016–2050) | Mixed (2016–2050) | High Renewable (2016–2050) | High Nuclear (2016–2050) | High CCS (2016–2050) |

|---|---|---|---|---|---|

| Coal | 57–83% | 40%–2% | 41%–5% | 40%–6% | 42%–58% |

| Combined-Cycle Gas | 70%–33% | 85%–60% | 86%–14% | 85%–36% | 86%–59% |

| Dispatchable Hydro | 38% | 38% | 38%–37% | 38% | 38% |

| Nuclear | 97% | 97%–96% | 97%–95% | 97%–94% | 97% |

| Offshore Wind | 44% | 36%–35% | 36%–34% | 36%–35% | 36% |

| Onshore Wind | 34% | 34%–31% | 34%–31% | 34%–32% | 34%–32% |

| Rooftop Solar | 17%–16% | 17% | 17% | 17% | 17% |

| Run-of-the-River Hydro | 39% | 39%–38% | 39%–37% | 39%–38% | 39% |

| Transmission-sited PV | 22% | 22%–21% | 22%–19% | 22%–20% | 22%–21% |

As these two tables indicate, after technology improvement and resource or grid availability are taken into account, PATHWAYS does not assume increasing capacity factors for wind or solar PV. Wind power sees a slight reduction in capacity factors at higher levels of capacity as the system is forced to constrain its output. In the Mixed Resources, High Renewables, and the High Nuclear Pathways, coal and combined-cycle gas plants show declining capacity factors as their use is ramped down over time.

Other components that go into developing supply curves for each technology are operating costs, including fuel costs when applicable, financing costs, and grid connection costs.